Power your bank with

AI built for growth

AI is rewriting the rules of banking. Traditional moats are vanishing, new ones are forming. Banks that win won’t bolt AI onto what they have. They will rebuild around it.

Trusted by

Banking unbound

The foundation starts here.

A business model built on value and trust. Real accountability from core to customer. Partners who understand banking and AI deeply enough to connect the dots.

Accelerate

Your path to an AI-first business model built around relationship-driven growth.

Deliver

Real AI ROI. Powered by the banking and AI expertise to build use cases that actually work.

Unlock

End-to-end transparency with a single thread of truth from your core to every customer interaction.

Who we help

Enabling smarter banking

innovation

We help banks accelerate agility, efficiency, profitability, compliance, and modernization – driving sustainable growth and transformative customer value

Retail banking

Create personalized relationships that drive advocacy

Effortlessly innovate and scale your product, pricing, and proposition strategies to deliver customer-centric, personalized offerings – while ensuring full transparency and regulatory compliance.

Corporate banking

Win and grow your most valuable relationships

Modernize deal execution, pricing, and billing to empower Relationship Managers, protect revenue, and compete for your most profitable commercial clients.

Data and IT

Modernize your core without the risk

Progressively modernize your core systems — rationalizing products, reducing integration complexity, and enabling transformation at your pace without disrupting operations.

Marketing

Turn marketing into your bank's growth engine

Launch faster, personalize at scale, and prove the ROI of every campaign — without depending on IT or wrestling with siloed systems.

Credit unions

Deliver more member value without the complexity

Recognize the full member relationship and deliver personalized, community-driven value — without replacing your core or compromising on fairness and trust.

Zafin’s AI culture

AI is infused into our DNA

We embrace AI as an enabler, powering how we build, design, and deliver; a collaborator, guided by our expertise; and a partner, delivering transparent, accountable outcomes.

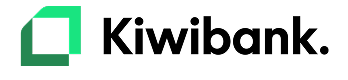

Control without compromise

Control without compromiseGovernance that scales with your bank

Control without compromise

Control without compromise

Governance that scales with your bank

Reduce risk compliance gaps through centralized governance, and scale operations without accelerating complexity

Integrate compliance logic directly into product configuration, pricing decisions, and partner interactions

Centralize agreement and compliance data at the point of distribution to ensure every interaction runs through appropriate governance controls

Automate governance workflows that adhere to regulatory standards while enabling speed and confidence

Accelerate with AI

Accelerate with AIBetter. Smarter. Faster.

When AI is embedded in how we think, work, and deliver, we move faster to meet your needs. Creating better, smarter, and faster outcomes to drive growth and relevance.

Benefit from continuous AI-powered product innovation built around your needs

Stay ahead of AI advances without having to navigate them alone

Ensure your AI investments deliver ROI with a platform designed around high-value banking use cases.

Accelerate with AI

Accelerate with AI

Better. Smarter. Faster.

Banking experience meets AI experts

Banking experience meets AI expertsThe AI-growth playbook for banks

Banking experience meets AI experts

Banking experience meets AI expertsThe AI-growth playbook for banks

You don’t have to be a fintech to win the AI era. But you do have to move. Get the banking knowledge, AI expertise, and roadmap to get there first.

Leverage proven expertise in where AI creates real, measurable value in banking

Ensure AI-readiness with a platform architecture built for governance and resilience

Drive growth with AI-powered offerings built on centralized product, pricing, and relationship logic

Zafin Platform

Purpose built for banking growth

Zafin’s AI-driven platform unifies data, enhances decision-making, streamlines workflows, and personalizes offerings – empowering banks to innovate with speed and precision and drive customer loyalty

Product and pricing

Govern. Simplify. Accelerate.

Bring clarity to your retail portfolio with a governed view of what you offer, how it’s structured, and where simplification creates value. Reduce complexity while increasing speed and flexibility.

Govern pricing logic across all channels

Configure modular products without IT

Adapt rates and fees in real time

Rationalize your retail portfolio faster

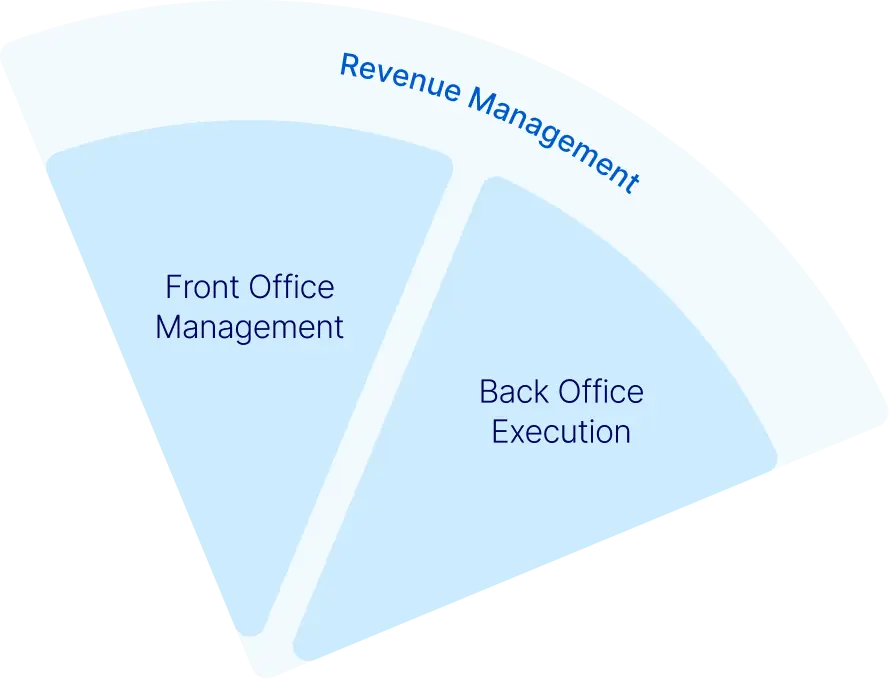

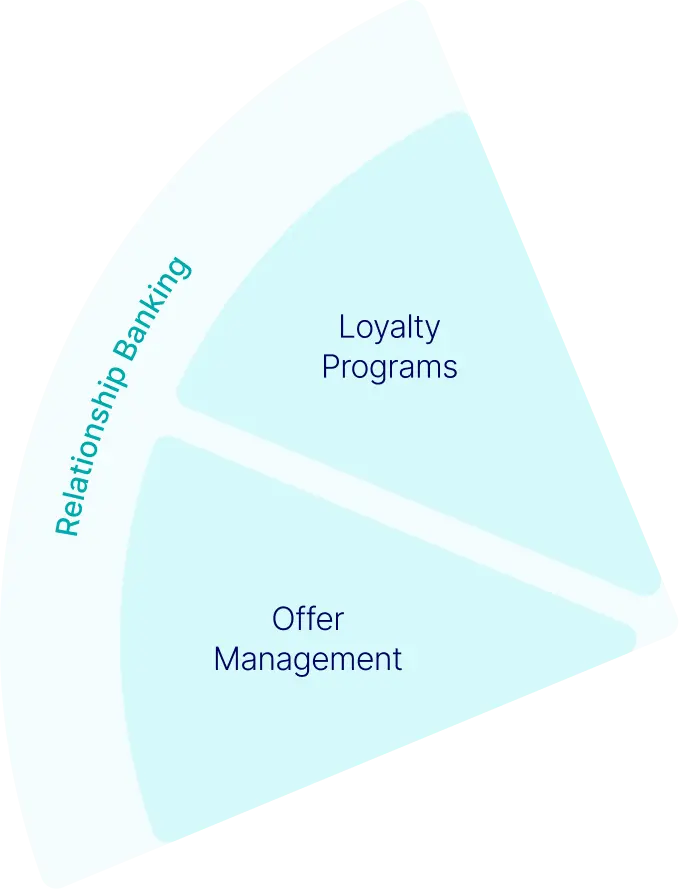

Relationship Banking

Loyalty that grows with your customers

Competing for primary relationships means delivering engagement that deepens over time. Convert early signs of attrition into sustained engagement and advocacy.

Design and execute offers end-to-end

Build tiered rewards that grow with customers

Trigger behavior-based loyalty in real time

Convert early attrition signals into engagement

Revenue Management

Turn operational chaos into client trust

Corporate relationships break down when pricing promises don’t survive execution. Connect deal negotiation, billing, and renewal into one governed system.

Govern deals from negotiation through billing

Eliminate the gap between promise and execution

Empower RMs with a single view of client history

Identify revenue leakage before it compounds

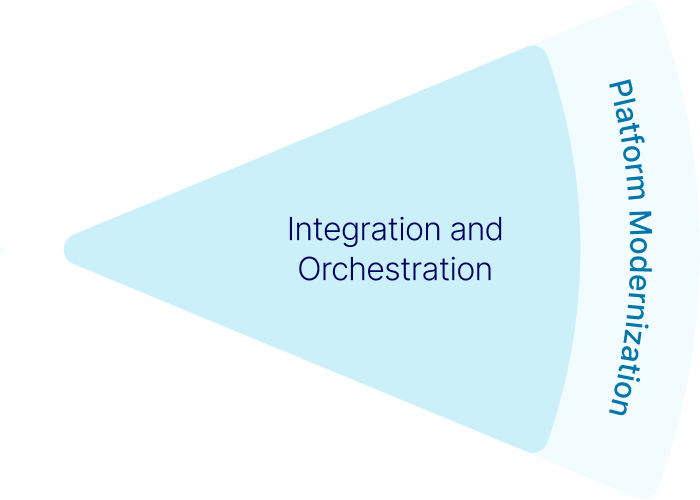

Platform Modernization

Modernize without disruption

Core transformation shouldn’t put the business at risk. Connect legacy and modern systems progressively, reducing integration complexity while continuously delivering value.

De-risk core modernization with proven connectors

Build and monitor pipelines without custom code

Integrate legacy and modern cores in parallel

Scale on cloud-native, BIAN-aligned architecture

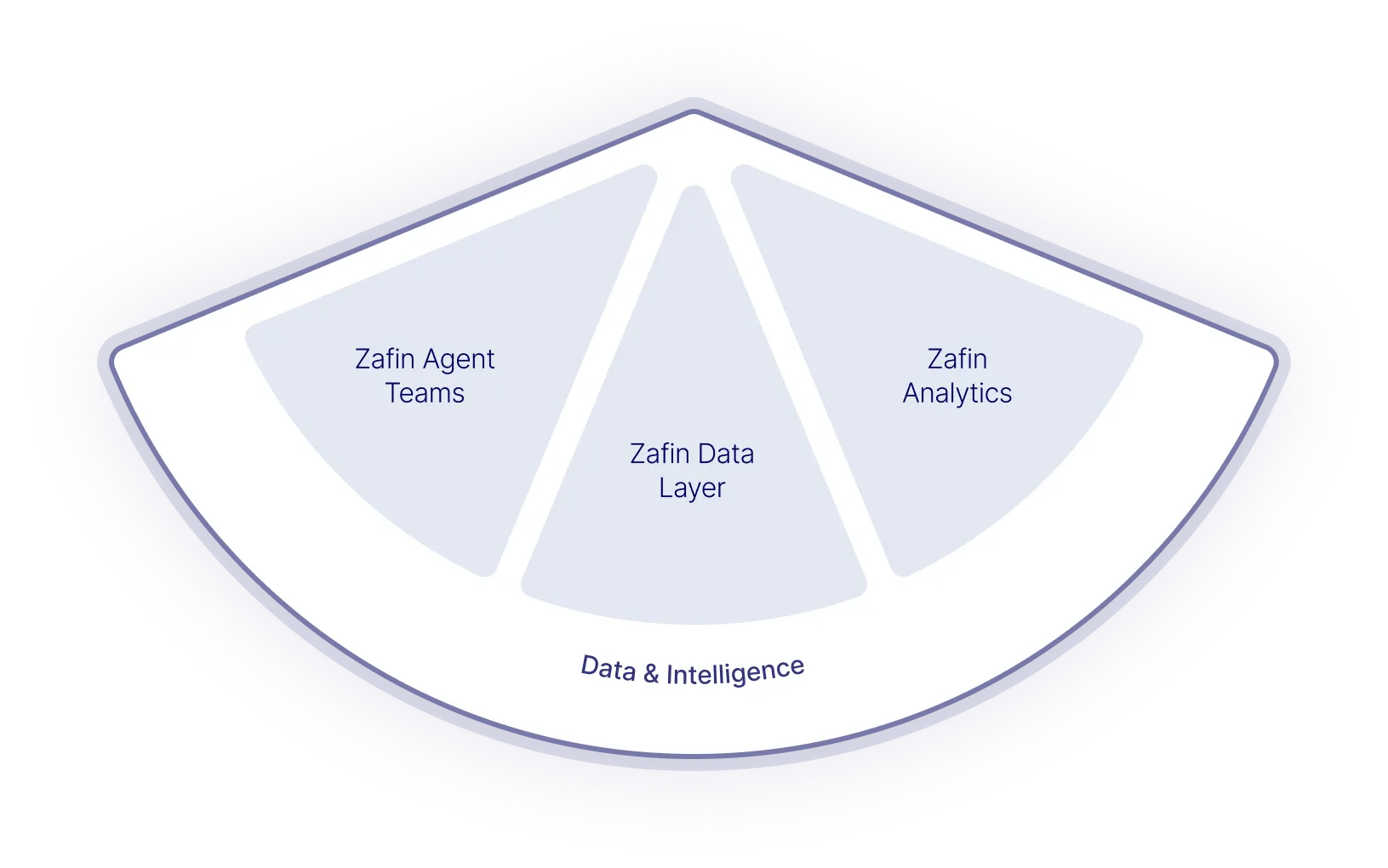

Data and Intelligence

Insight that drives action

Power smarter pricing, timely offers, and proactive engagement through a unified intelligence layer that is shaped by advanced AI and guided by seasoned industry advisors who understand the realities of modern banking.

Unify data across products, relationships, and decisions

Surface behavioral signals before customers disengage

Power dynamic segmentation and real-time offers

Identify pricing and renewal opportunities as they emerge

Worldwide reach

Serving financial institutions around the globe

Zafin doesn’t rest until your business goals are met. We have teams around the world ready to make your bank more efficient, more profitable and ultimately more customer-centric

5 of the Top 7 US banks

Run on the Zafin platform

95% reduction in time to launch

New products and propositions

500M+ accounts

processed every day

Connect with us

Explore how Zafin can help your bank accelerate innovation, drive growth, and deliver personalized banking experiences without disrupting your core