Managed Rates Engine

Increase NIM, streamline operations, and stay compliant with an automated rate change management process

Increase NIM with dynamic pricing aligned to hedging strategies

Set up rule-based pricing models that dynamically adapt to market conditions, risk exposure and business objectives

Streamline operations and improve efficiency

Automate rate setup and distribution, and leverage Zafin AI for step-by-step pricing offset recommendations

Ensure regulatory compliance and transparency

Maintain audit-ready workflows for rate determination with automated tracking and full visibility

Increase NIM

Increase NIM with dynamic pricing

Go beyond index-based pricing with adaptive rates tailored to business strategies, hedging approaches and market dynamics

Increase NIM with smarter pricing adjustments

Protect margins from rate fluctuations by dynamically adjusting pricing based on risk management strategies and market conditions

Improve control over margins by reducing reliance on index-based pricing

Move beyond purely index-linked pricing (e.g., SOFR, Fed Funds) with managed rates that factor in liquidity needs, customer behavior, and competitive positioning

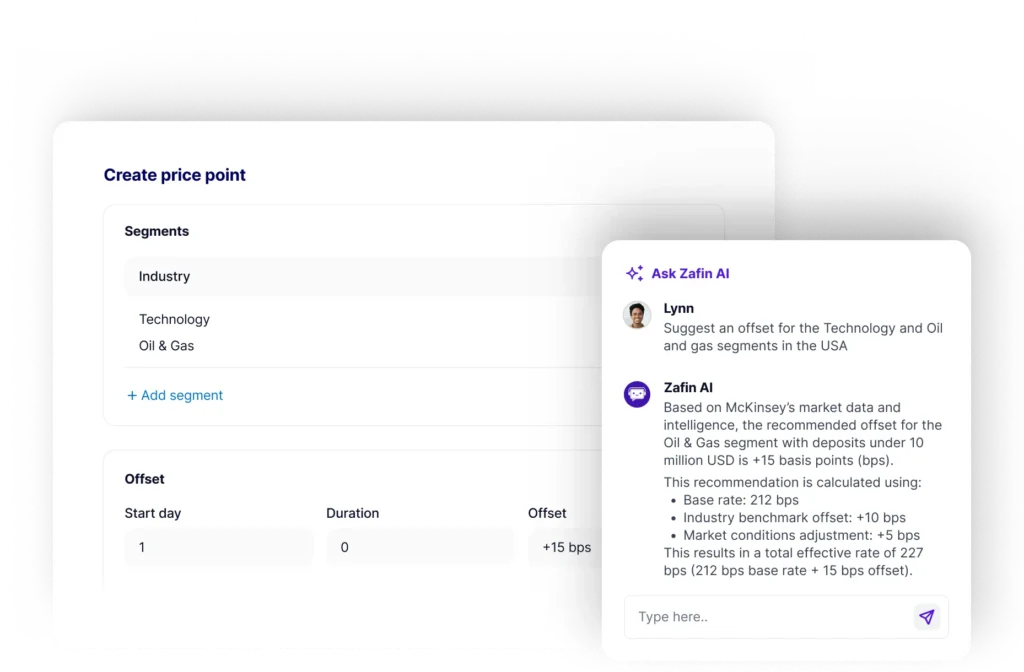

Tailor rates easily

Empower LOBs to tailor rates at a client-level based on geography, segments, products, and more

Operational efficiency

Centralize rates management for efficiency and agility

Go beyond index-based pricing with adaptive rates tailored to business strategies, hedging approaches and market dynamics

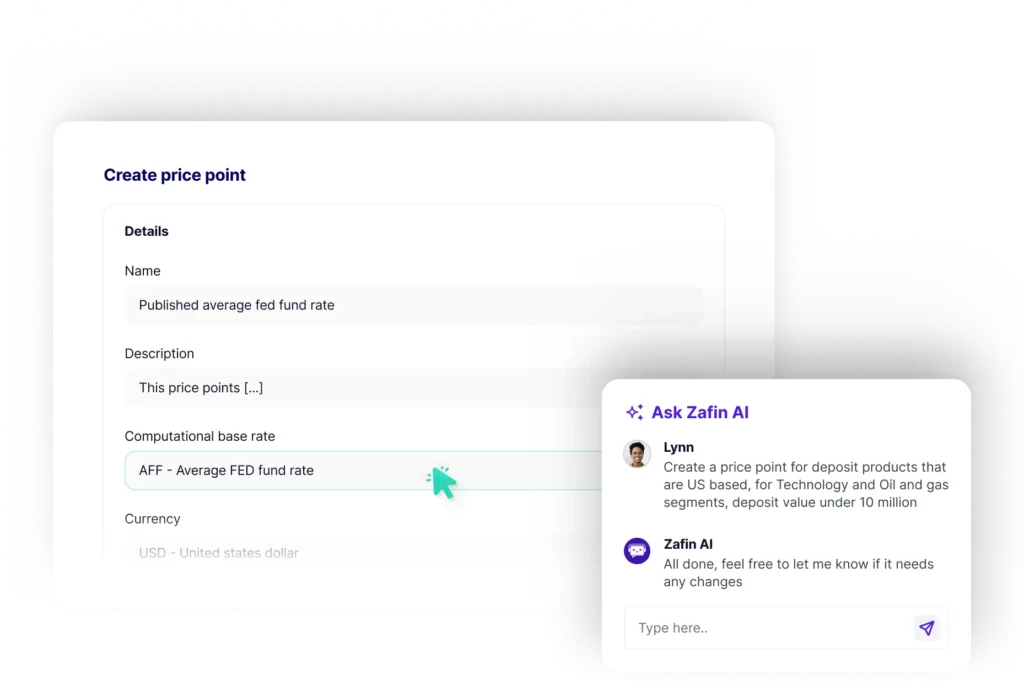

AI-powered rate setup

Accelerate rate setup and minimize errors with guided step-by-step pricing offset recommendations from Zafin AI

Standardize pricing models

Protect liquidity, profitability, and risk exposure with standardized pricing models and built-in guardrails and controls

Distribute rates seamlessly

Automatically distribute updated rates across your existing ecosystem

Regulatory compliance

Ensure transparency and regulatory compliance

Maintain full visibility into rate execution while ensuring compliance with evolving regulations

Enforce regulatory-compliant rate execution

Ensure rate execution aligns with Basel III and local regulatory mandates

Ensure regulated liquidity levels

Proactively adjust rates to maintain liquidity levels and mitigate NIM fluctuations caused by rate changes

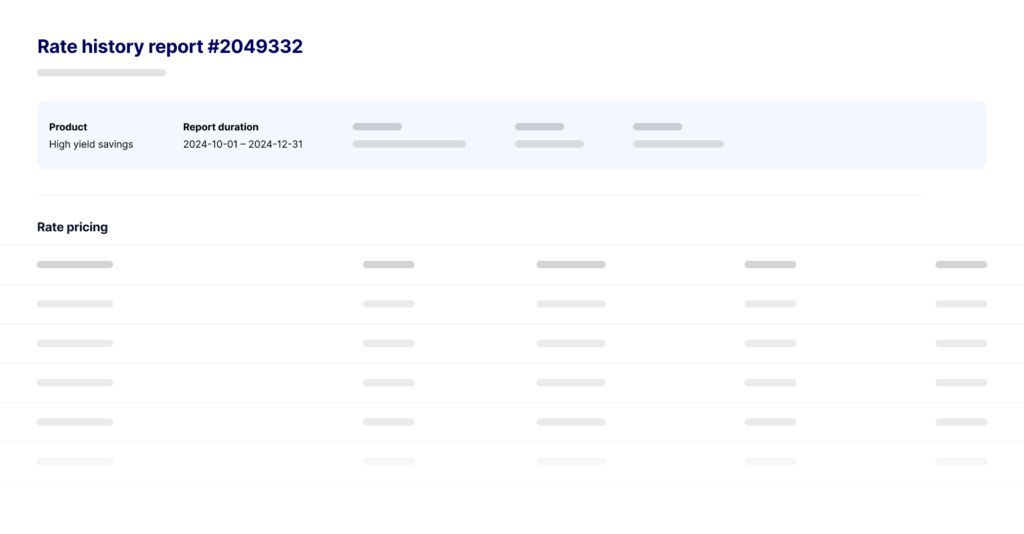

Maintain full audit trails

Capture every rate change, approval, and application in a centralized, audit-ready format

Provide client-specific rate transparency

Enhance client trust with full transparency into rate determination and execution

Quick time to market

Deploy rapidly with seamless integration

Go live faster with minimal disruption by integrating seamlessly with core banking and treasury platforms

Quick, out-of-the-box implementation

Accelerate onboarding and achieve faster time-to-value with minimal disruption

Integrate instantly with core banking systems

Leverage pre-built connectors to accelerate implementation without system overhauls

Automate rate execution with APIs

Enable real-time rate updates across all banking products with API-driven automation

3 months

For a G-SIFI global bank

Connect with us

Optimize banking rate management with Zafin’s Managed Rates Engine. Automate pricing, enhance transparency, and boost profitability. Connect with our experts.