Building for the future of banking

The next generation of customer-obsessed banking

Deliver the outcomes customers value most – orchestrated across partners, platforms, and AI with the transparency and trust the ecosystem depends on.

Today’s customer financial ecosystem

Banking happens everywhere, regardless of the bank

A woman is shown at the center of the image, representing a customer. She is surrounded by logos of many brands and platforms connected with dotted lines, forming a financial ecosystem.

Logos included:

Finance / fintech: PayPal, Venmo, Robinhood, Wise, Klarna, Coinbase, Acorns, Square

Tech & payments: Google Pay, Amazon, Walmart, WeChat, WhatsApp

Consumer & lifestyle: Starbucks, Uber, TikTok, Greenlight

Text labels in the network highlight:

Marketplace

Embedded lending

Linked partnerships

The visual conveys that customers engage in financial activity across diverse apps and services, not just within their primary bank. It illustrates how banking now happens everywhere, across institutions and platforms, and how this shift reduces banks’ share of the customer’s financial life.

Our solution

Transform scale and trust into a competitive edge

Zafin enables banks to leverage what fintechs and platforms cannot match, their depth of scale and regulatory trust, to become the indispensable foundation of customer financial ecosystems. Our AI-powered platform centralizes the logic that makes orchestrating unified, governed outcomes possible everywhere the customer engages.

The impact

Become loyalty leaders with unmatched value

Banks become loyalty leaders by delivering superior value that inspires customers to consolidate their financial lives. Platform integrations accelerate scaling while creating revenue resilience through diversified partnerships. The result is sustainable growth built on competitive advantages that others cannot replicate.

Guide

Ecosystem Banking: Redefining Relevance in a Platform Economy

Learn how ecosystem banking shaping how banks thrive in the platform econoomy.

Propel trust and scale at your bank

Unlock your competitive advantage

Transform how you deliver value by moving from customer awareness to customer obsession, orchestrating strategic partnerships, and embedding governance into every interaction.

![]() Customer-obsessed culture

Customer-obsessed culture

Better outcomes, stronger relationships

The central focus is a home buyer, pictured alongside a house marked “For sale.” Above the house, a message reads “Offer accepted.”

From this center, dotted lines radiate out to several icons representing financial services:

A house with a dollar sign (mortgage or financing)

A refresh symbol (process or ongoing service)

A house with a roofline (home ownership)

A shield (protection or insurance)

A connectivity symbol (partner services)

The arrangement illustrates how a customer’s journey, like buying a home, connects to multiple financial services and partners. The emphasis is on the customer’s goal — securing a home — rather than on isolated financial products. This supports the idea of a customer-obsessed culture, where banks shift from product-centric thinking to customer-centric outcomes.

Better outcomes, stronger relationships

Shift from product-centric to customer-centric thinking by prioritizing what customers are trying to achieve

Provide complete customer insights with unified data across all business lines

Build solutions customers want through product optionality, and create bundles across internal and partner services

Extend capabilities beyond traditional banking with partner-enabled services that enrich the customer experience

Value-driven partnerships

Value-driven partnerships

Scale your partnership network

Integrate automated governance and centralized data into your partner network to accelerate scale and mitigate risk, enabling expanded service capabilities and accelerated growth through platform distribution

Ensure relationship accuracy with centralized agreement data that provides complete visibility into all partner relationships

Automate partner orchestration to reduce operational overhead and manual errors

Reduce compliance risk with embedded governance integrated directly into the partnership agreement

Value-driven partnerships

Value-driven partnerships

Scale your partnership network

The image shows a grid of brightly colored circles on a dark background. Inside the circles are a mix of company logos and simple icons.

Logos visible include:

Amazon Alexa (light blue circle)

Gusto (orange circle)

Coinbase (blue circle)

American Airlines (white circle)

Realtor.com (red circle)

Other icons represent:

A yellow arrow pointing up and right

Three red stacked coins

A teal building outline

A teal wallet

A teal shopping basket

A white heart

Several smaller dark circles with a “+” symbol suggest additional partners being added.

The visual conveys the concept of a scalable, value-driven partner ecosystem, where banks and platforms integrate with a wide variety of partners. The surrounding “plus” icons emphasize expansion, growth, and extensibility of the network. This ties to the strategic message: integrating automated governance, centralized data, and orchestration reduces risk while accelerating partner-enabled growth.es.

Governance that scales with your bank

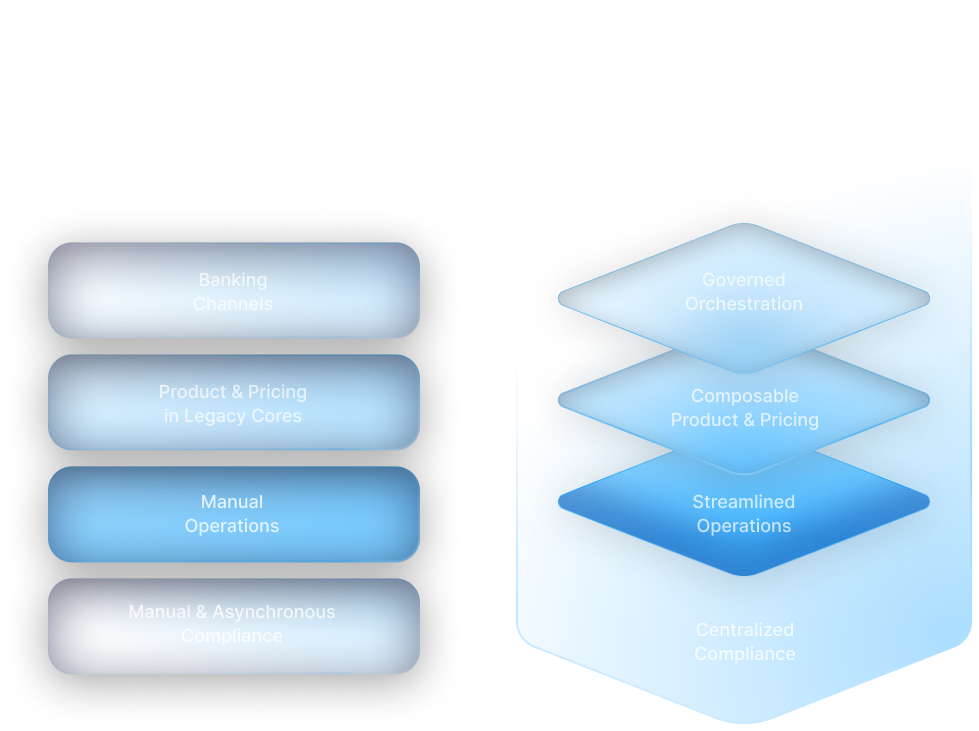

The image contrasts two columns labeled Yesterday and Tomorrow.

On the left, under Yesterday: High risk and limited orchestration, four stacked rectangles show:

Banking Channels

Product & Pricing in Legacy Cores

Manual Operations

Manual & Asynchronous Compliance

Arrows point to the right column, Tomorrow: Compliant trustworthy orchestration, where four diamond shapes represent:

Governed Orchestration

Composable Product & Pricing

Streamlined Operations

Centralized Compliance

The visual emphasizes the shift from fragmented, manual, and risky processes toward a future of centralized governance, streamlined operations, and compliance embedded directly into orchestration. It illustrates how banks can reduce risk, integrate compliance logic into everyday processes, and scale with confidence.

Governance that scales with your bank

Reduce compliance gaps through centralized governance, and scale operations without accelerating complexity

Integrate compliance logic directly into product configuration, pricing decisions, and partner interactions

Centralize agreement and compliance data at the point of distribution to ensure every interaction runs through appropriate governance controls

Automate governance workflows that adhere to regulatory standards while enabling speed and confidence

The path forward

Your transformation journey begins now

The pace of change in banking is only accelerating. The time to act is now, regardless of where you’re starting from. We work with your unique constraints to turn today’s position into tomorrow’s competitive advantage. Define your stage below and discover how we can help.

1. Based on findings from Accenture Global Banking Consumer Study

Act now to define the future of banking

Join us for a tailored executive workshop with our Industry advisory team where we will shape a strategy for how your bank can compete and win in the platform economy.

Bank leaders that act now will define the shape of financial ecosystems for the next decade. Zafin’s Industry Advisory team offers tailored executive sessions to help you chart your path. Together, we will assess your readiness, frame the opportunity, and align your leadership team around a strategy to compete and win in the ecosystem economy.