September 01, 2023

In my prior blog, I had discussed deposit modernization as a foundational element of core system modernization. While this can take many forms, a common theme emerging is modernization along product lines within deposit. Oftentimes, banks find that term deposit systems (CD’s in the US) offer a low-risk yet high-value means of beginning the process. In this blog, we will explore the approach taken by a tier 1 US bank.

In the very volatile rate environment that we find ourselves in, being able to adjust and tailor rates for unique sub-segments is critical to be able to attract net new money. Further, existing customers are also demanding better rates and the inability to do that means greater odds of either attrition or deposit outflows. Faced with these issues, tier 1 US bank sought to create an environment whereby business users can tailor rates based on region, current product holdings to name a few attributes. This would give the business the flexibility and agility to tailor rates for new CD’s in specific markets to attract net new money.

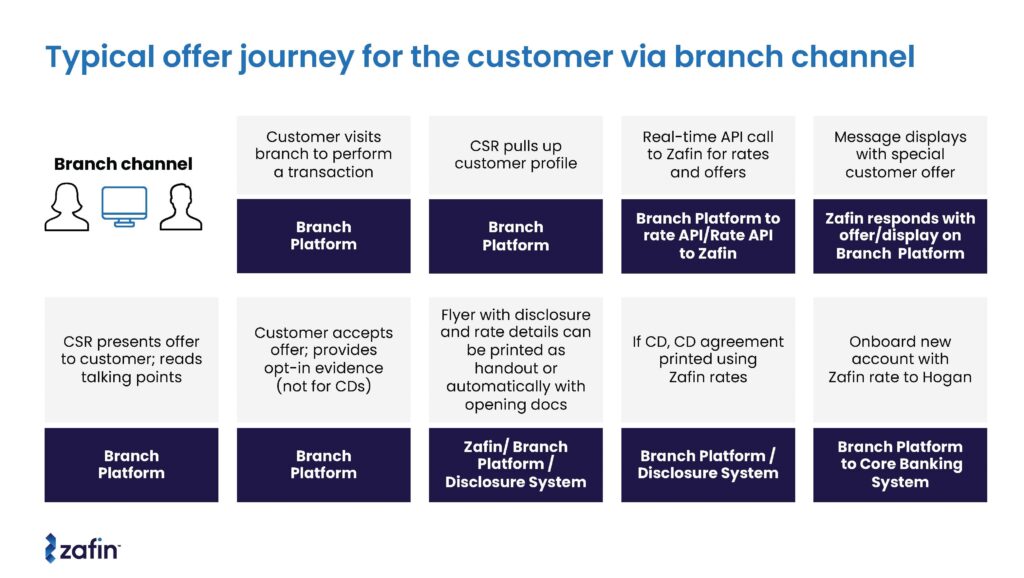

To put that in perspective, imagine a typical branch journey for a customer. In this journey, presenting a timely offer with personalized rates that are dynamically configurable would extend the flexibility greatly through business agility.

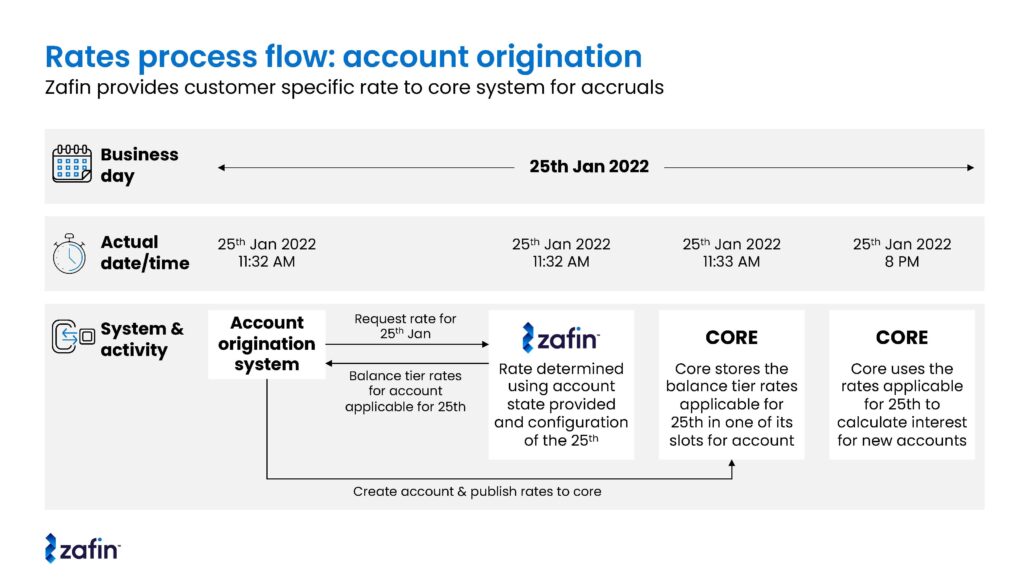

When viewed as a flow diagram, it could be seen as follows:

With this flow, with a simple modification to an existing API, flexibility and agility can be brought into an existing system of origination in very short order.

In the case of this tier 1 US bank, we were able to bring about this flexibility and agility inside of 8 weeks. As a result, they saw a >50% increase in approved CD volumes post launch. There are upwards of 5M rate calls served by Zafin daily across tier 1 US bank’s prospects and new customers across branch and digital channels enabling the bank to target specialized rates by multiple criteria.

In the end, the modernization was enabled by externalization of rates and is now being extended to other products and cross bank use cases.

Stay ahead of the curve. Join us next month for an insightful article about Mastering Money.

Founded in 2002, Zafin offers a SaaS product and pricing platform that simplifies core modernization for top banks worldwide. Our platform enables business users to work collaboratively to design and manage pricing, products, and packages, while technologists streamline core banking systems.

With Zafin, banks accelerate time to market for new products and offers while lowering the cost of change and achieving tangible business and risk outcomes. The Zafin platform increases business agility while enabling personalized pricing and dynamic responses to evolving customer and market needs.

Zafin is headquartered in Vancouver, Canada, with offices and customers around the globe including ING, CIBC, HSBC, Wells Fargo, PNC, and ANZ.