Having just come back from SIBOS 2023, the theme of ‘Collaborative finance in a fragmented world’ rings so true across the entire financial system no matter where in the world you are. The topics explored there surrounded sustainable and inclusive industry, management during these uncertain times as well as the balance between technology and trust. It was the aspect of uncertain times that truly captured my imagination, as risk increases, and trust erodes. During these times, it is important to delve deeper into the topic of uncertainty, not just focusing on its economic or geopolitical aspects.

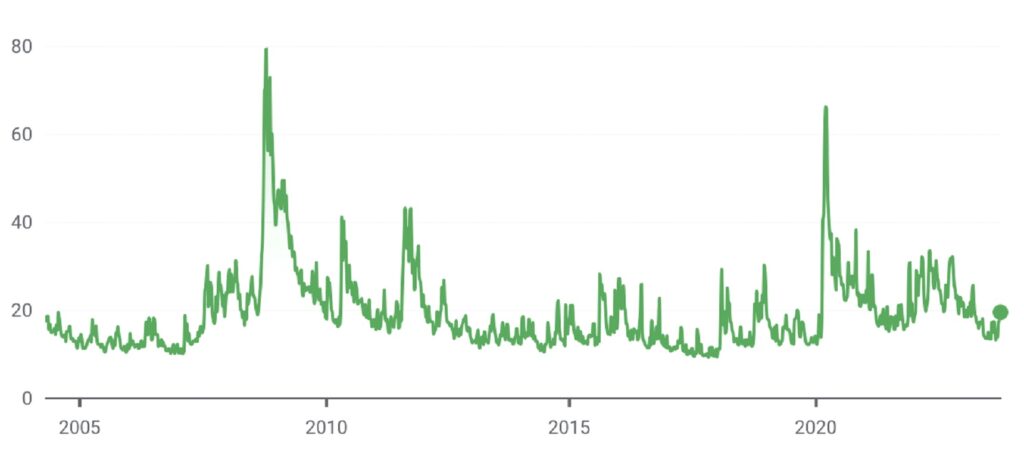

For the majority of the past two decades, we have been experiencing a period of constant volatility, primarily fueled by uncertainty. From the session “The Macroeconomics of Uncertainty and Volatility” organized by Stanford University, a paper titled “Pricing in Distress”1 discusses that ‘When uncertainty increases it creates two confounding effects: a realization effect and an anticipation effect. These two effects may have opposing results on current behavior.’ With the rapid changes that you will observe in the VIX chart below, we seem to be drifting from one distress to another thus creating further stress on pricing.

VIX historical chart

Source: https://www.google.com/finance/quote/VIX:INDEXCBOE

This distress effect was probably conceptualized when the Fed decided to adopt its quantitative easing to try and quell the anticipation effect thus reducing stress in the system. However, that is not a long-lasting or a permanent solution, as was realized when the Fed-funds rate started down the path to increases.

The historical Fed-funds chart serves as evidence that the heightened uncertainty we are currently experiencing, especially in recent weeks, is a persistent phenomenon that will continue until we receive news regarding future volatility.

Fed-funds rate historical chart

Source: https://www.macrotrends.net/2015/fed-funds-rate-historical-chart

It is against this backdrop that I re-visited the Accenture paper ‘Top 10 Trends for 2023 – The gravity of rising rates’2 and focused on the five key forces of change they envisioned. Product Innovation is the key to get out of the conundrum forced upon banking on account of the low-rate environment that persisted previously. Accenture concluded that “The banks that are likely to succeed over the next year and beyond will be those that bring their siloed products back into an integrated offering…”. Based on our own experiences with banks throughout the year, we have witnessed a shift from siloed products into offerings that span multiple back-end core systems, enabling true innovation to take place.

At Zafin, our innovation around the creation of a cross-product layer that can span multiple core systems while externalizing product, pricing and its related functions gives banks precisely that ability to create integrated offerings that allow greater differentiation while delivering superior customer experience.

Uncertainty can create opportunities for those who are prepared. At Zafin, we assist banks in getting ready for such eventualities. The time to innovate is now!

- Presented by: Felipe Saffie (University of Virginia)

Co-author(s): Boragan Aruoba (University of Maryland), Andres Fernandez (IMF), and Ernesto Pasten (Central Bank of Chile) - https://www.accenture.com/content/dam/accenture/final/industry/banking/document/Accenture-Banking-Top-10-Trends-2023.pdf#zoom=40

Stay ahead of the curve. Join us next month for another insightful article.

Founded in 2002, Zafin offers a SaaS product and pricing platform that simplifies core modernization for top banks worldwide. Our platform enables business users to work collaboratively to design and manage pricing, products, and packages, while technologists streamline core banking systems.

With Zafin, banks accelerate time to market for new products and offers while lowering the cost of change and achieving tangible business and risk outcomes. The Zafin platform increases business agility while enabling personalized pricing and dynamic responses to evolving customer and market needs.

Zafin is headquartered in Vancouver, Canada, with offices and customers around the globe including ING, CIBC, HSBC, Wells Fargo, PNC, and ANZ.