Zafin Agreements

Banks run on data. Customers run on trust.

The problem

Banks need data they can trust

Diagram illustrating Zafin Agreements as a centralized system of reference that unifies product and service agreement data to ensure consistent interpretation and usage across banking functions.

Two example interactions highlight real-world use cases:

Eligibility Confirmation via Customer Service (bottom left):

A chat interaction shows a customer named Eric asking, “How do I qualify for gold tier?” The automated response reads: “Congratulations Eric! Because you have direct deposit for your savings account and you have a mortgage with us, you already meet gold tier status.” This demonstrates how service teams can instantly reference verified agreement criteria, eliminating manual interpretation and enabling faster, more accurate service resolution.

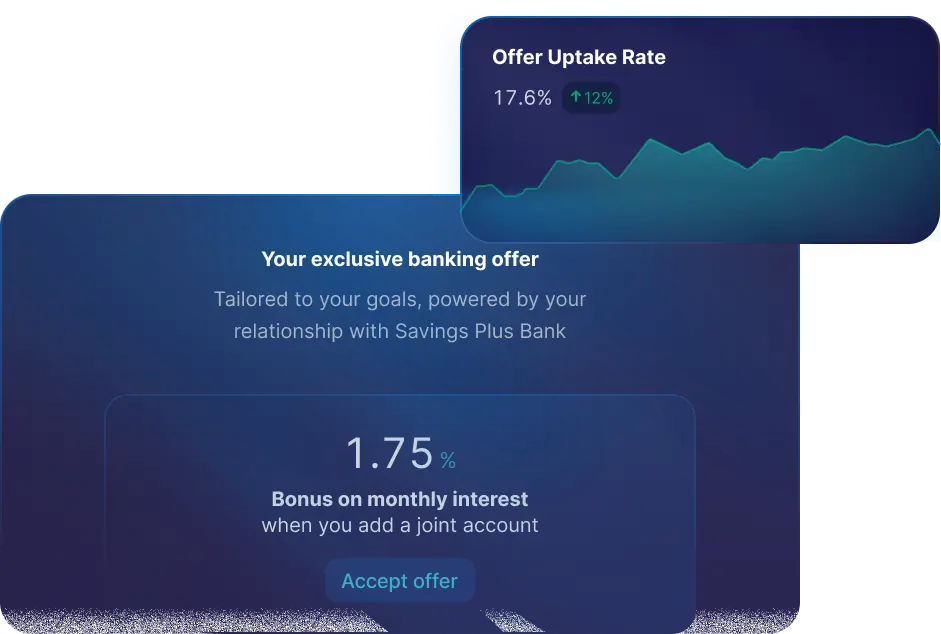

Contextual Offer Logic (top right):

A promotional banner reads: “New exclusive banking offer! 1.75% bonus interest when you add a joint account.” This illustrates how verified agreement context supports tailored marketing logic. Instead of relying on broad segmentation, offer eligibility is driven by real agreement data across products and customer relationships.

Our solution

Transform complexity into relationship clarity

Zafin Agreements addresses data fragmentation by centralizing agreement and arrangement data into a unified system of reference to create an accurate and trusted view of every customer relationship.

The impact

Better data, impactful products, customer trust

Unlock the full value of your data to power personalized offers and rewards that go beyond traditional banking, provide real-time visibility for frontline teams, simplify compliance, and reduce revenue leakage.

How it works

Customer relationship orchestration for banks

Go beyond contracts to unlock trusted, real-time data – modernizing your data, boosting customer loyalty, and enabling every team to act with clarity

Modernize your data

Modernize your data

Build a trusted data foundation for modernization

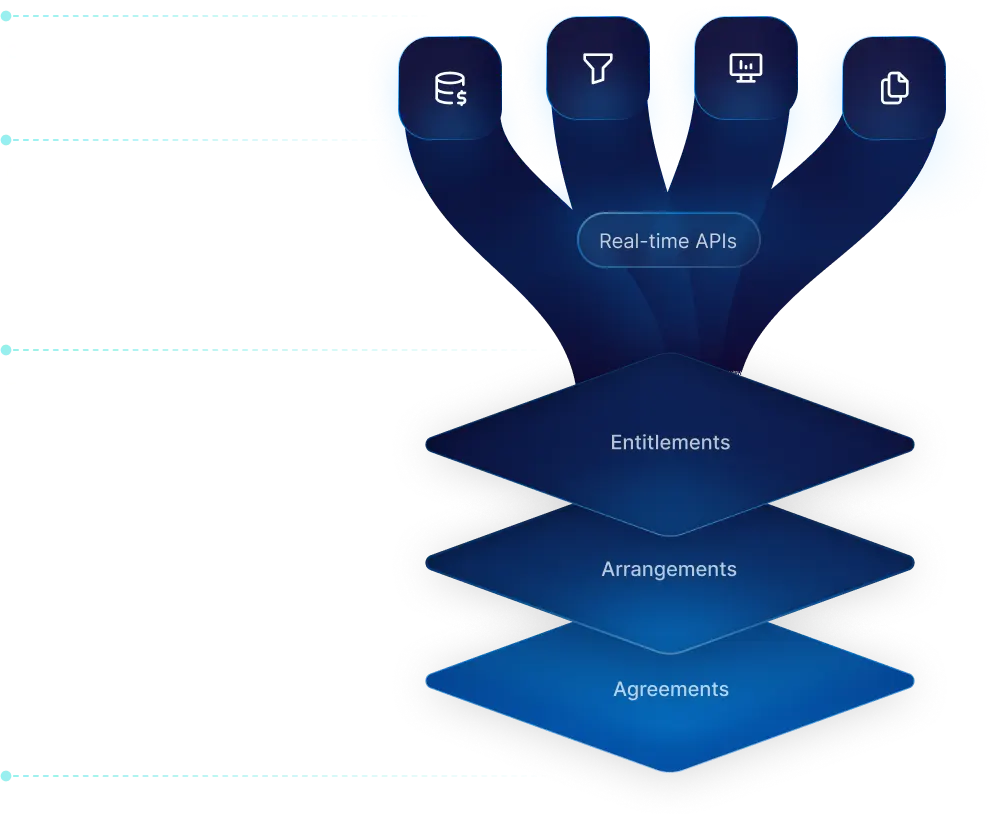

This diagram illustrates Zafin’s architecture for product and service agreement data management, organized into three conceptual layers.

Foundation layer (Bottom)

Unified, verified system-of-reference for product and service agreements and related data.

Depicted as a stack of three horizontal layers labeled “Agreements,” “Arrangements,” and “Entitlements.”

Connection layer (Middle)

Standardize integration with real-time APIs.

A grouping labeled “Real-time APIs” connects the foundational agreement data to upstream systems.

Channel layer (Top)

Connect systems of engagement and record. Four curved branches extend upward to icons representing different systems – pricing engines, analytics tools, customer service platforms, and digital channels.

Modernize your data

Modernize your dataBuild a trusted data foundation for modernization

Eliminate silos and reduce complexity with a unified data foundation built for scale

Provide clarity across the enterprise with centralized agreement data

Make agreement data lifecycle-aware, audit-ready, and instantly accessible for onboarding, servicing, and compliance workflows

Ensure scalability with BIAN-aligned data

Boost loyalty

Boost loyalty

Power lasting loyalty with a unified relationship view

Enable delivery of personalized, contextual, and timely offers

Gain a full view of every customer

Deliver value beyond traditional banking products and services through ecosystem partnerships and bundled offerings

Surface the right offer at the right time, then fulfill it with precision

Boost loyalty

Boost loyaltyPower lasting loyalty with a unified relationship view

Enable your teams

Enable your teamsMake relationship data accessible, actionable, and auditable across the entire bank

Enable your teams

Enable your teamsMake relationship data accessible, actionable, and auditable across the entire bank

Empower frontline, operations, risk, and advisory teams with a shared, always-current view of agreement data

Automate agreement tracking across products, lifecycle events, and pricing changes to support proactive servicing and compliance

Integrate agreements directly into tools teams already use, via flexible APIs, such as CRMs, servicing platforms, and onboarding systems

Strengthen fraud investigations with full visibility into customer agreements, entitlements, and relationship history

Bank-wide impact

Unlock value across your bank

Power better servicing, personalization and execution by making agreement data accessible, trusted and actionable across the bank

1. Based on findings from Cornerstone Advisors Report on Improving Your Financial Institution’s Data IQ

Connect with us

Talk to of our our industry experts to see how Zafin can help you improve your data reliability