Transaction data enrichment

Enrich every transaction using smarter financial data APIs

Unlock the signals hidden within your transaction data to power customer insights, personalized experiences, and loyalty programs that drive primacy. Our APIs enrich transactions with modern categorization, merchant details, and do so with best-in-class accuracy and coverage.

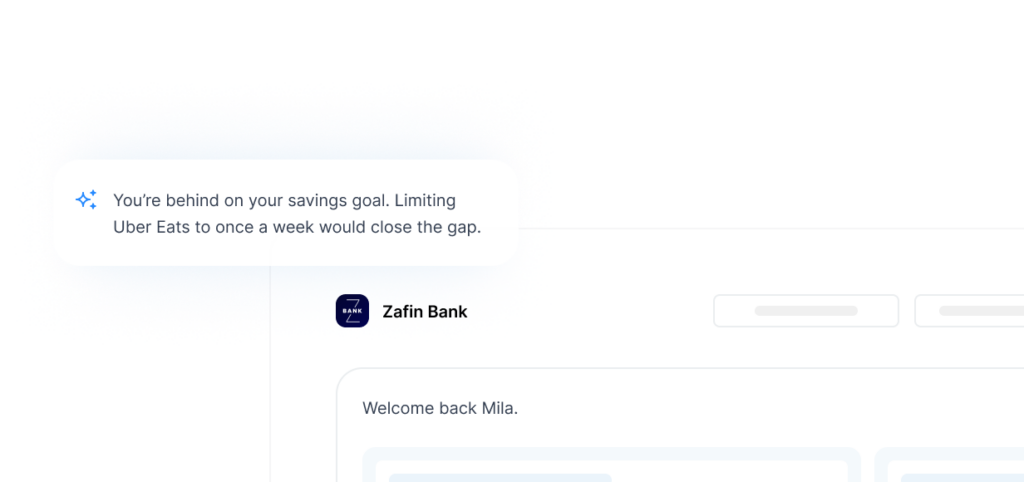

Enable intelligent experiences

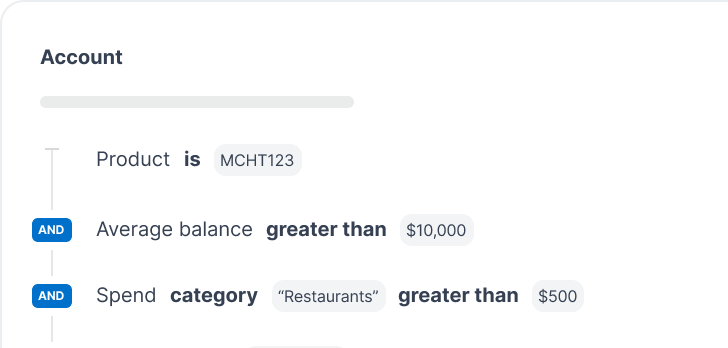

Segment with precision

Build confident segmentation strategies based on spending profiling and behavioral analyses

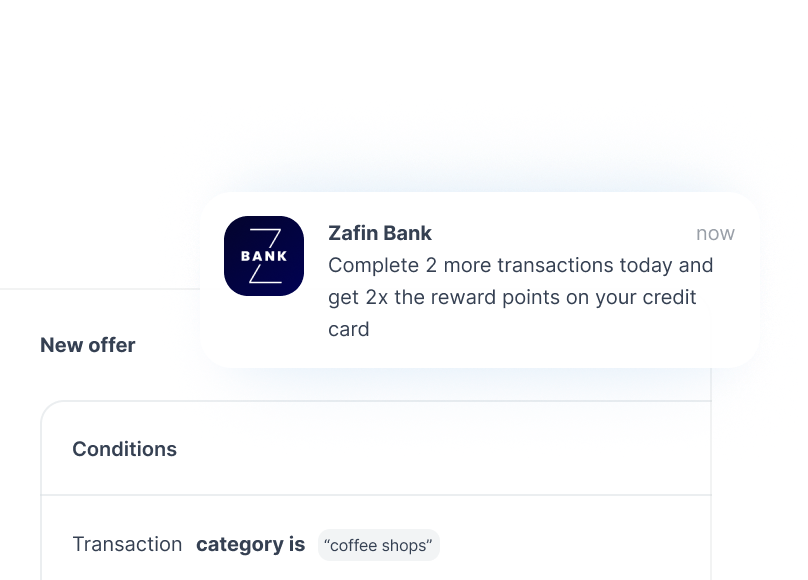

Create offers that matter

Design loyalty programs and promotions that match how customers actually live

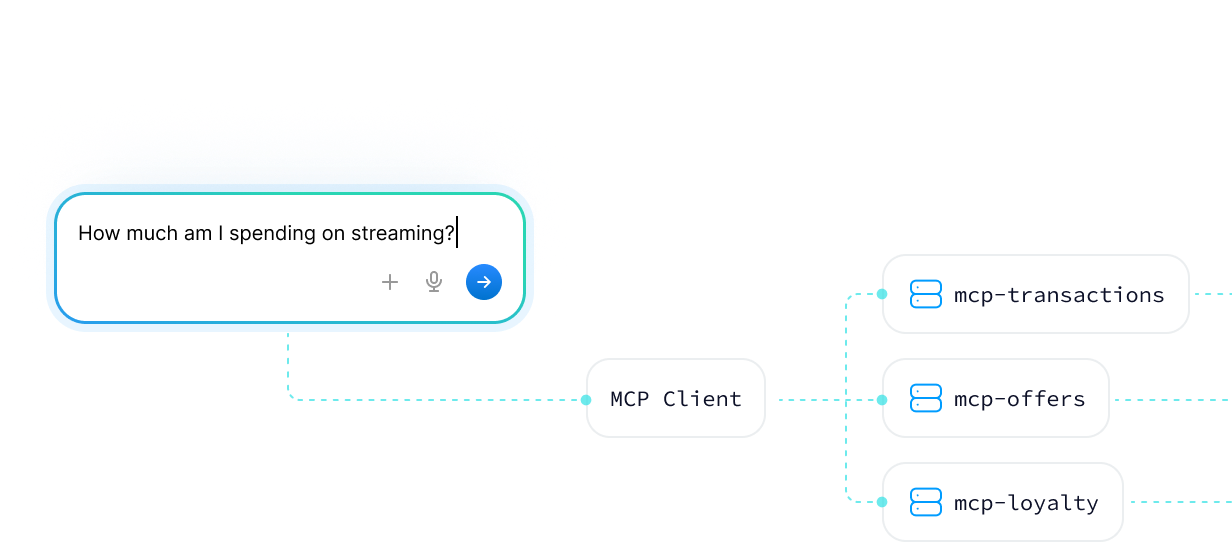

Make your data AI-ready

Transform raw transaction data into structured intelligence that powers conversational banking and advanced analytics

Try it out

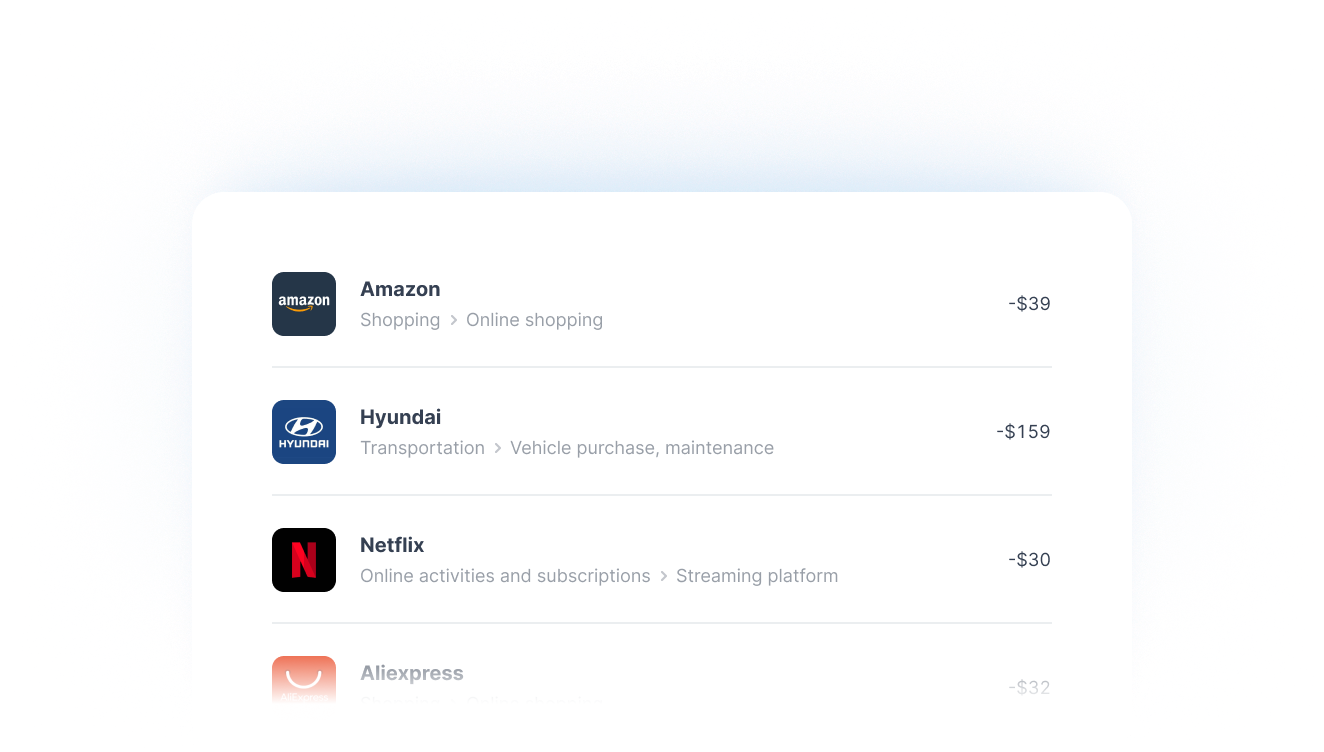

See Transaction Enrichment in action

Instantly transform raw transaction data into clear categories, recognizable merchants, and actionable insights. Select a sample transaction or try your own below to experience smarter banking firsthand.

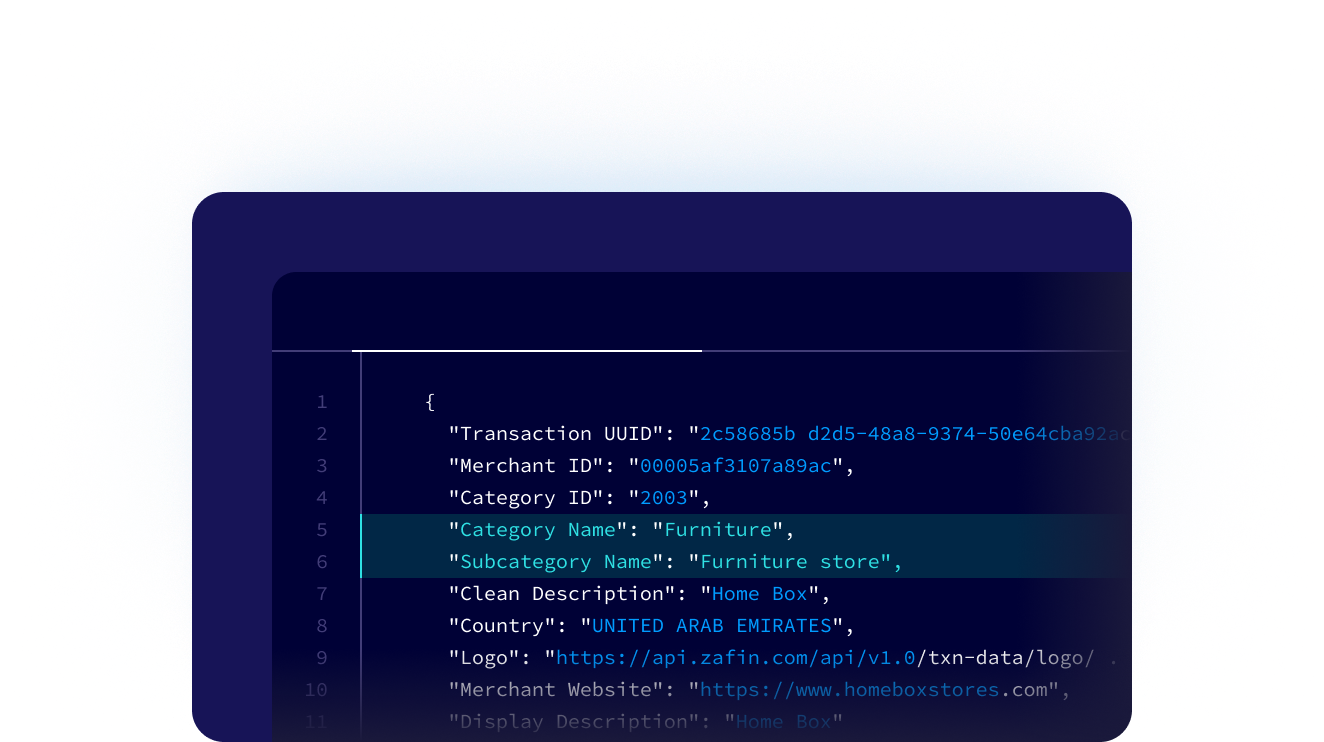

API Response:

{}Features

AI-powered transaction data enrichment and categorization APIs

Transform raw, unstructured data into actionable insights by categorizing transactions and enriching merchant details with transaction data enrichment and transaction categorization APIs.

Contextual data enrichment

Contextual data enrichment

Transform raw transaction records into rich, contextualized data using:

70 expense and income categories

Merchant logos

Clean merchant names

Merchant website links

Adaptive accuracy engine

Ensure confidence in your data with built-in intelligence that improves over time

Machine learning models that continuously adapt to new patterns

Feedback loops that incorporate human input to enhance precision

Adaptive accuracy engine

Effortless API integration

Effortless API integration

Integrate enrichment capabilities quickly and reliably across systems

Vast, well-documented set of API endpoints

Multi-lingual transaction support

Efficient batch API calls

Source-agnostic data enrichment

Your questions answered

Frequently asked questions

Find answers to frequently asked questions about Transaction Enrichment and how it helps banks and fintechs deliver better customer experiences. If you still have questions, you can talk to our experts.

What is Transaction Enrichment?

Transaction Enrichment converts raw financial or payment data into clear, contextualized records. It improves customer transparency (payment recognition), personalization, cross-selling and loyalty through:

- Transaction Data Enrichment cleans and enhances unstructured data for accurate insights , via a total of five enrichment fields

- Transaction Categorization classifies transactions into meaningful, granular spending categories

- Merchant Enrichment adds verified merchant names, logos, and identifiers for easy recognition

- Better Banking Experiences enables personalized insights, budgeting tools, and improved trust

How does Transaction Enrichments help banks and fintechs? What are its key features?

Transaction Enrichments helps banks and fintechs clean, categorize, and label messy transaction information, so you can deliver more value, boost engagement, and power smarter products. By transforming raw bank data into clear insights, you unlock personalized customer experiences, better money management tools, and stronger loyalty. This in turn helps grow customers share of wallet, reduce attrition and achieve primacy, through a wide array of data-driven use cases, including but not limited to cross-selling.

Key features:

- Merchant name/brand cleaning: Corrects spelling errors, removes codes, and adds clean brand names to raw merchant descriptions

- Merchant logo and website: Displays recognizable brand logos and links to the merchant’s website

- Categorization: Assigns intuitive, human-friendly categories and sub-categories like “Groceries” or “Dining Out.”

- Location enrichment: Adds geographic data to help you understand spending behavior by city, region, or country

- Custom labels and tags: Tailor categorization to your own business needs or customer segments

- International coverage: Supports transactions globally, not just in the U.S. or Canada

- Higher accuracy and coverage with machine learning: Built using a continuously trained AI engine and proprietary database for reliable, scalable enrichment

What is the difference between transaction data enrichment and transaction categorization ?

Transaction Data Enrichment cleans and enhances records where as transaction categorization classifies each transaction into standardized spending categories. To further simplify:

- Enrichment = cleaning + context

- Categorization = consistent labels for spend and income behavior analysis

How does the Transaction Enrichment API work?

The Transaction Enrichment API processes raw feeds and returns enriched, categorized, merchant-labeled transactions by:

- Combining transaction data enrichment, transaction categorization , and merchant enrichment

- Leveraging a single API endpoint

Does Transaction Enrichment work for international transactions?

Yes. Zafin’s Transaction Enrichment capability supports international transactions as well as domestic ones. It uses a combination of merchant-data normalization, AI-driven pattern recognition, and multiple global data-partner feeds to recognize and enrich purchases that originate outside a cardholder’s home country.

How accurate is the enrichment?

Transaction enrichment and categorization are highly accurate, powered by continuous learning and global data sets. Accuracy rates improve further as the system processes more transactions, ensuring reliable results for both financial institutions and customers.

What are the benefits of using Transaction Enrichment APIs?

Transaction Enrichment offers the following benefits

- Improves customer clarity

- Personalizes banking experiences

- Cleans transaction data for use in downstream use cases including banks internal analytics.

- Strengthens customer loyalty and

- Powers timely and hyper-relevant cross-selling and offers.

With enriched data, banks and fintech providers can offer features like spending insights, budgeting tools, and merchant recognition directly within their digital apps.

How does Transaction Enrichment increase customer loyalty for banks?

Transaction Enrichment builds customer loyalty by making banking experiences clearer and more personalized in the following ways:

Accurately identifies merchants and categories, reducing confusion and powering loyalty programs that rely on precise data.

Enables contextual rewards and offers through reliable categorization and merchant recognition.

Delivers personalized insights and recommendations, helping banks engage customers with meaningful value that builds long-term loyalty.

How does Transaction Enrichment improve ROI for banks?

Transaction Enrichment improves ROI by enhancing both operational efficiency and customer engagement. It:

- Reduces disputes and support costs through clearer, more transparent transaction data.

- Enables personalization that drives higher customer satisfaction and stronger loyalty.

- Increases share of wallet and customer primacy by powering tailored rewards, offers, and experiences that keep customers engaged.

- Deepens relationships and fights attention fatigue by ensuring every interaction feels relevant and rewarding.

Can enriched data be used for advanced analytics?

Yes. Banks can use enriched transaction data for segmentation, trend analysis, fraud detection, and personalized product recommendations.

Is my financial data secure when using Transaction Enrichment?

Yes. Transaction Enrichment follows strict data privacy and compliance standards. It never exposes personal identifiers and processes only what is required to deliver enriched insights.

Our insights on Transaction Enrichements

Connect with us

Talk to our experts to explore how Zafin’s AI-powered banking platform accelerate product and pricing strategies, driving business agility