November 27, 2021

Even as an increasing number of banks have started to look critically at their underlying core banking systems, with an eye to modernizing them in place, the need for an overarching architectural perspective has started to emerge. Three key reasons for this emerging perspective, including the need for:

- Greater business agility, which is driven by the accelerating pace of customer expectations and experiences;

- End-to-end digital enablement to overcome the interlaced processes that exist in current legacy banking technology systems; and

- Cost-effective delivery which is primary enabled by cloud delivery models.

While some banks have started with their front-end channels to try and enable customer experiences, others have embarked on the painstaking task of reworking their underlying core systems. In the first scenario, most banks have fallen short of customer expectations and in the second, banks have been challenged with improving – or even fostering – business agility.

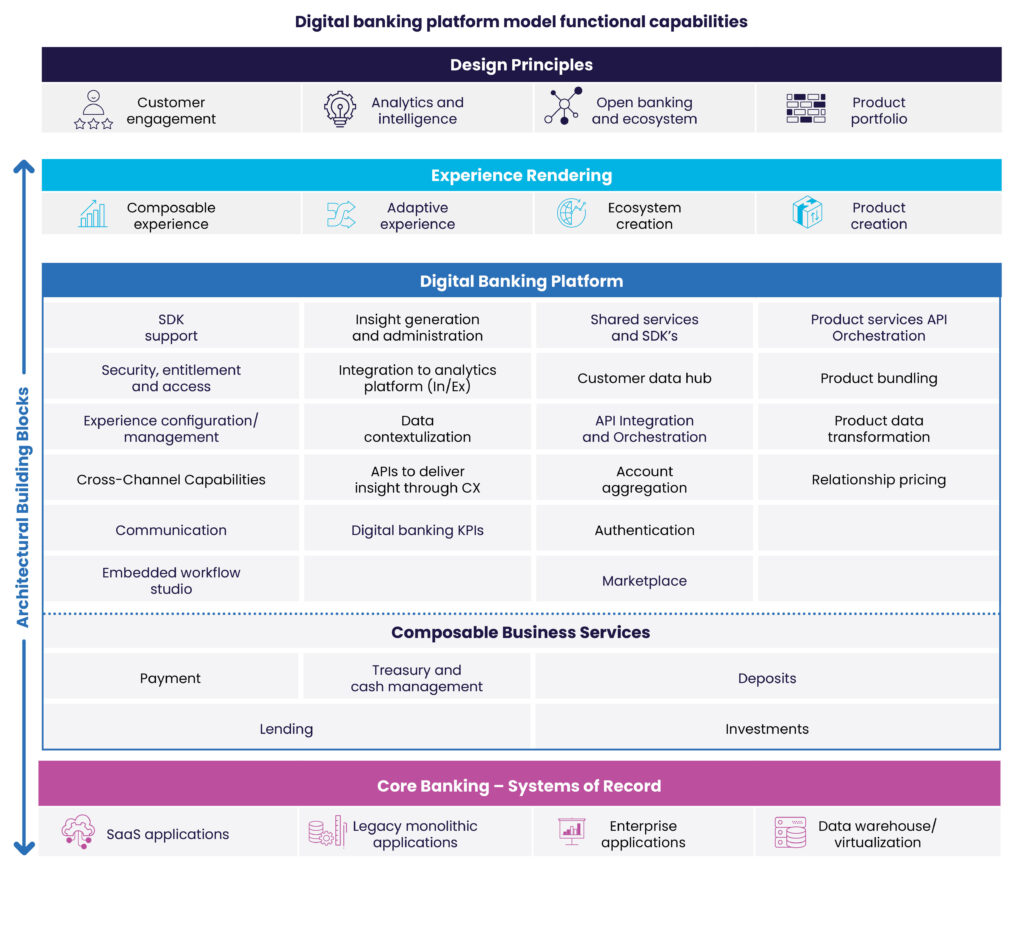

In fact, in recent days, Gartner has also published a very thorough report on their view of the building blocks required to meet the growing needs around digital banking. This report postulates that the architectural view needs to look like the below depiction:

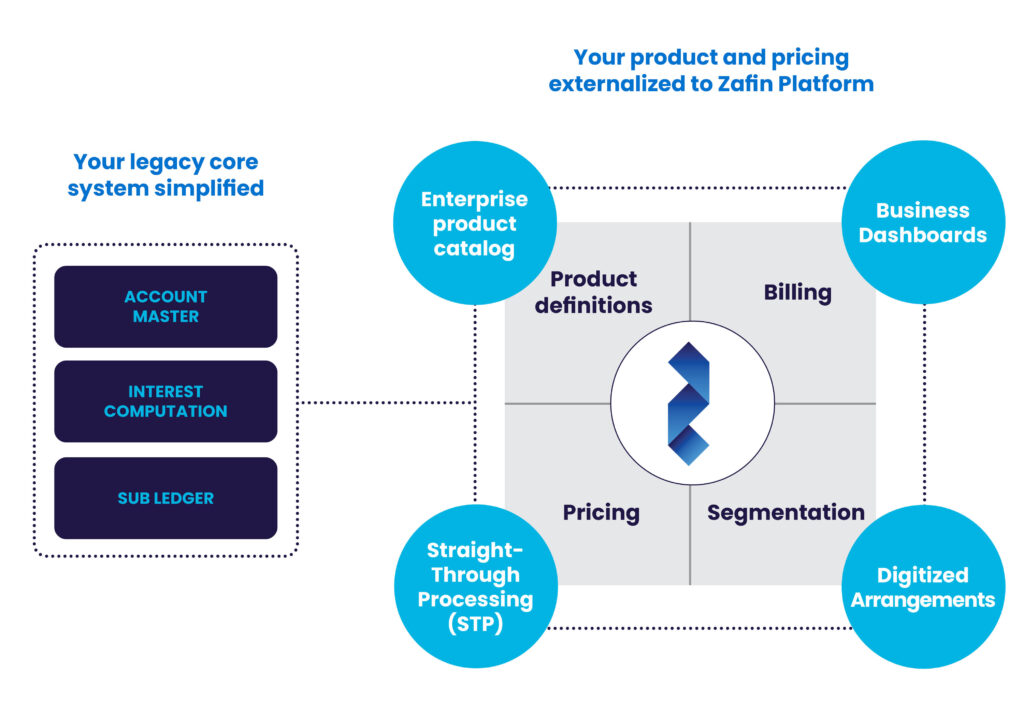

At Zafin, we have studied both the drivers and the underlying challenges banks face at length, and have evolved our architecture to perfectly enable banks to address the key factors described above. Zafin’s perspective aligns very well with this depiction as our cloud-native product and pricing platform allows banks to deliver value quickly by empowering banks to create composable business services at different paces. We help serve to externalize product, pricing and related functions from the Core Banking Systems of Record through the creation of a Cross-Product Layer that is external to core systems. Through this effort, banks can improve their business agility by responding to market needs and customer wants quickly.

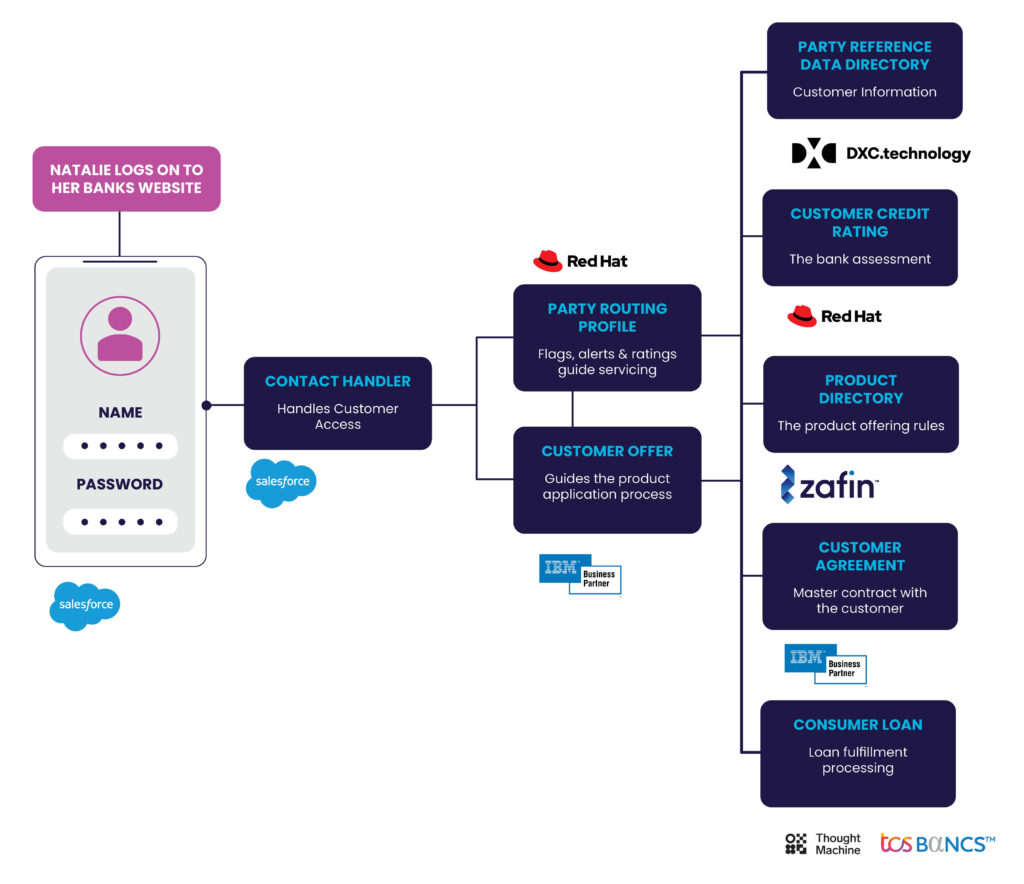

Zafin’s partnership and work with the Banking Industry Architecture Network (BIAN) has helped spearhead two proof of concepts thus far that demonstrate business architecture that spans the end-to-end process for offers management in banking.

Functionally, at the Digital Banking Platform layer, Zafin’s product and pricing platform provides for almost half of the capabilities required and articulated above. and is also key to the Experience Rendering layer through our work with Product Creation (all the way from Ideation). As we create more of these composable services in addition to the building blocks that Zafin has already created, we remain confident that our strategy and work-to-date has the architectural principles espoused by major research organizations as well as standards organizations at its core.

Want to learn more about the architecture and building blocks that will help your bank leapfrog your digital banking efforts? Contact us at [email protected]

Founded in 2002, Zafin offers a SaaS product and pricing platform that simplifies core modernization for top banks worldwide. Our platform enables business users to work collaboratively to design and manage pricing, products, and packages, while technologists streamline core banking systems.

With Zafin, banks accelerate time to market for new products and offers while lowering the cost of change and achieving tangible business and risk outcomes. The Zafin platform increases business agility while enabling personalized pricing and dynamic responses to evolving customer and market needs.

Zafin is headquartered in Vancouver, Canada, with offices and customers around the globe including ING, CIBC, HSBC, Wells Fargo, PNC, and ANZ.